What to know when filing your tax return this year…

The Tax Cuts and Jobs Act of 2017 was signed into law in late December of 2017. This tax reform bill is the most significant tax change in the United States in over 30 years. As the 2019 tax filing season is in full swing, take a few minutes to educate yourself on what has changed, and how it will impact your tax return.

From new tax brackets to changes in deductions and credits, there’s a lot of new information to absorb. Here are some helpful tips for homeowners on these tax changes and how they may impact your return.

Standard Deduction Changes

One of the biggest changes brought on by theTax Cuts and Jobs Act is with the standard deduction, which has nearly doubled. A “tax deduction” is any item that can reduce your taxable income. According to the Motley Fool, “Before the increase, about 70% of U.S. households used the standard deduction, but now it is estimated that roughly 95% of households will use it.” This means that unless your itemized deductions exceed the standard deduction, you should stick with the standard deduction.

Here are the standard deduction amounts for the 2018 and 2019 tax years:

Mortgage Interest

Yes, the mortgage interest deduction still exists under the Tax Cuts and Jobs Act, but there’s a chance it may not be as valuable as it was before.

Homeowners are allowed to deduct the interest they pay on as much as $750,000 of qualified personal residence debt on a first and/or second home. This has been reduced from the former limit of $1 million in mortgage principal plus up to $100,000 in home equity debt.

The Motley Fool notes that “the deduction for interest on home equity debt has technically been eliminated for the 2018 tax year and beyond. However, if the home equity loan was used to substantially improve the home, the debt is considered a qualified residence loan and can, therefore, be included in the $750,000 cap.”

State Income Tax or State Sales Tax

The IRS gives taxpayers the choice to claim either their state and local income tax or their state and local sales tax as an itemized deduction. Naturally, if your state doesn’t have an income tax, the sales tax deduction is the way to go. On the other hand, if your state does have an income tax, then deducting that will generally save you more money than deducting sales tax.

Tennessee has no income tax, but does have a “hall tax” — that is, a 6% tax on interest and dividends, which is specifically allowed by the state constitution. Tennessee also has a minimum sales tax of 7% but can be as high as 10% depending on the county (i.e. Knox County is 9.25%).

Use the IRS calculator to help easily determine your sales tax deduction, as you do not necessarily need to retain every single receipt from the year.

Capital Gains

There is good news for those of you who sold your primary residence in 2018 and owned it for at least 2 of the last 5 years. You are exempt from paying capitals gains if the net gain was less than $250,000 (single) or $500,000 (married & filing jointly)! Check out the article for more details…

Property Taxes

Property taxes paid on homes, cars, boats, airplanes or other personal property can be counted towards itemized deductions. This deduction and the deduction for income or sales tax are collectively known as the SALT deduction — that is, the “state and local taxes” deduction.

The Tax Cuts and Jobs Act limits the total amount of state and local taxes you can deduct — including property taxes and sales/income tax — to $10,000 per year. So if you live in a high-tax state or simply own some valuable property that you pay tax on, this could significantly limit your ability to deduct these expenses.

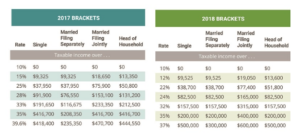

Tax Brackets

The Tax Cuts and Jobs Act also updates tax brackets. Here’s a look at what’s shifted, courtesy of H&R Block:

Overall, the actual numbers inside of these ranges have shifted. The tax brackets for 2018 are slightly broader, and rates are slightly lower. H&R Block notes that the new tax brackets mean that most taxpayers will pay less tax. That said, we always urge our clients to speak with an accountant to get a full understanding of their options for capital gains before filing their tax returns.

For the bigger picture and everything that has changed with the Tax Cuts and Jobs Act, we recommend a deeper dive into any of these helpful articles:

https://www.fool.com/taxes/2019/01/13/your-2019-guide-to-tax-deductions.aspx

https://finance.yahoo.com/news/2019-guide-tax-deductions-155000172.html

https://www.hrblock.com/tax-center/irs/tax-reform/new-tax-brackets/